Investing your hard-earned money is a crucial step towards securing your financial future. However, with numerous investment options available in the market, it can take time to choose the right one. If seeking a balanced approach to wealth creation, consider aggressive hybrid mutual funds.

Meaning of aggressive hybrid funds

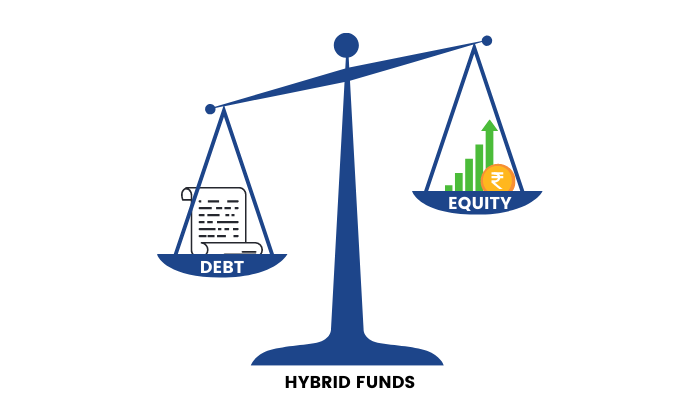

Aggressive hybrid funds, also known as balanced hybrid funds, are a type of mutual fund that combines the features of both equity and debt mutual funds. These funds aim to strike a balance between wealth growth and capital preservation. They are designed to offer investors the best of both worlds, allowing you to benefit from the potential returns of equity investments while mitigating risk with the stability of debt funds.

How do aggressive hybrid funds work?

Asset allocation: The key to aggressive hybrid funds lies in their asset allocation strategy. These funds invest in a mix of equities and debt instruments, with a higher allocation to equities. The equity portion can range from 65% to 80% of the total assets, while the remaining is invested in debt securities. This blend ensures that you have the potential for capital appreciation while also enjoying a safety net provided by the debt component.

Professional management: Aggressive hybrid funds are managed by experienced fund managers who make strategic investment decisions. They monitor market conditions, economic trends, and individual securities to optimise the fund’s performance. Their expertise helps in achieving the fund’s dual objectives of growth and stability.

Risk diversification: By investing in a mix of asset classes, aggressive hybrid funds reduce risk. During market fluctuations, the debt component acts as a cushion, limiting the impact of market volatility on the overall portfolio. This diversification helps protect your investments from extreme swings.

Reasons to consider investing in aggressive mutual funds

Balancing risk and return: Aggressive hybrid funds are ideal for investors who want a balanced approach to wealth growth. The combination of equities and debt funds allows you to enjoy the growth potential of stocks while cushioning against market downturns. This is especially advantageous for risk-averse investors who seek capital preservation.

Stable returns: The debt portion of these funds provides a stable source of income through interest payments and capital appreciation. This can be particularly beneficial for those who rely on their investments for regular income, such as retirees.

Professional expertise: Aggressive hybrid funds are managed by skilled professionals with the expertise to make informed investment decisions. They constantly monitor the market and adjust the fund’s portfolio to maximise returns while managing risks.

Tax efficiency: In India, aggressive hybrid funds enjoy tax benefits. They are treated as equity investments for tax purposes, meaning long-term capital gains (investments held for over one year) are tax-free. This tax advantage can enhance your overall returns.

Liquidity: These funds offer liquidity, allowing you to redeem your investments anytime. The ease of entry and exit makes them suitable for short-term and long-term investors.

To wrap up

Whether aggressive hybrid funds are the best option for you will depend largely on your financial objectives and risk tolerance. Thus, give careful thought to your requirements and preferences, and think about consulting a financial advisor to develop an investment plan that suits your unique situation.